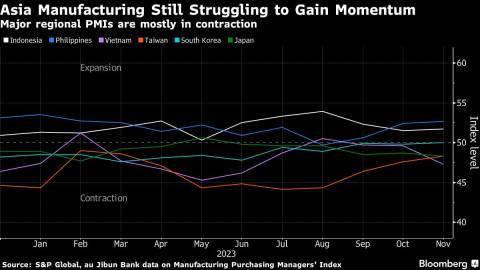

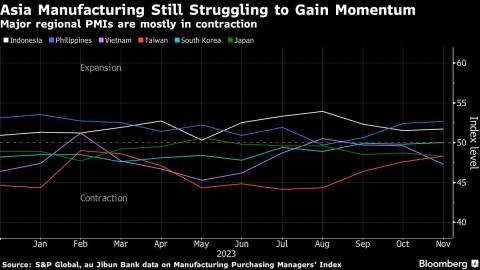

(Bloomberg) -- Key gauges of activity at Asia’s factories failed to turn around the bearish sentiment in November, as global demand for goods remained soft and China’s faltering economic recovery tempered any optimism.

While manufacturing purchasing managers’ indexes for South Korea and Taiwan showed signs of stabilization in activity, the mood in Japan was downbeat, according to surveys published Friday by S&P Global and au Jibun Bank. A private gauge of factory activity in China unexpectedly returned to expansion.

The reading for Vietnam deteriorated as factories were squeezed by higher input costs and consumers were unwilling to pay higher prices. The score for Malaysia and Thailand improved although still remained below 50, the dividing line between contraction and expansion.

Trade bellwether South Korea finally ended a 16-month stretch of manufacturing decline with a PMI of 50 — right on the waterline. Manufacturers increased staffing and buying on signs of improving demand. South Korea’s exports recovery likewise accelerated in November, rising 7.8% from last year thanks to a turnaround in semiconductor shipments.

While electronics hub Taiwan saw its PMI climb to 48.3, its best showing since March, Japan fared worse due to sharper drops in both output and new orders. “Panel members often commented on weak customer demand in both domestic and international markets,” Usamah Bhatti at S&P Global Market Intelligence said on Japan’s performance.

Meanwhile, the Philippines and Indonesia saw an increase in orders pushing their PMIs higher to 52.7 and 51.7, respectively.

“If customer demand continues to wane, it will be detrimental to ASEAN manufacturing sector performance in the months ahead. Furthermore, business confidence regarding the year-ahead remains historically muted across the region,” S&P economist Maryam Baluch said on Southeast Asia.

Asia’s manufacturing performance is seen as an important gauge for the health of global trade, and the latest set of PMI data paints a varied picture.

It follows similar mixed signals out of China, underlining fragility within the world’s second-largest economy and adding pressure on the government to provide more stimulus measures to sustain momentum headed into next year.

The export-oriented Caixin manufacturing PMI jumped to 50.7, beating estimates of 49.6 on Friday. However, the official manufacturing PMI fell to 49.4 on Thursday, marking the second straight month of contraction.

(Updates with China Caixin PMI in the second paragraph, and South Korea exports data in the fourth.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Author: Claire Jiao