(Bloomberg) -- Intel Corp., the world’s biggest maker of computer processors, fell far short of analysts’ second-quarter sales and profit estimates and slashed forecasts for the year, weighed down by a drop in demand for data-center chips and a steep decline in PC shipments. Shares tumbled as much as 12% in late trading.

Revenue in the second quarter fell 22% to $15.3 billion, significantly below the average analyst estimate of $18 billion. Per-share profit excluding some items was 29 cents, Intel said Thursday in a statement, while analysts had predicted 69 cents. Sales in the current period will be as low as $15 billion, compared with projections of $18.7 billion.

After two years of growth in personal-computer shipments, spending on laptop and desktop machines is declining quickly as rising inflation is leading consumers to shy away from large purchases. The market for chips that power PCs is still Intel’s biggest source of revenue -- and the cash needed to fund an ambitious attempt by Chief Executive Officer Pat Gelsinger to restore the company to semiconductor-industry leadership.

While investors had anticipated PC sales would weigh on Intel’s performance, an unexpected 16% drop in revenue from the expensive server chips that contribute a large chunk of the company’s profit dragged down overall revenue and profit. Prices are falling and customers are cutting orders to pare stockpiles of unused chips, Intel said.

“This quarter’s results were below the standards we have set for the company and our shareholders,” Gelsinger said in the statement. “We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues.”

Intel shares slid as low as $35.11 in extended trading, after closing at $39.71 in New York trading. The stock has fallen 23% this year, in line with the drop in the broader Philadelphia Semiconductor Index.

In the recent quarter, data-center division sales slid to $4.6 billion, compared with the average analyst estimate of $6.04 billion. Client computing, Intel’s PC-chip unit, saw sales plummet 25% to $7.7 billion, compared with an average projection of $8.76 billion.

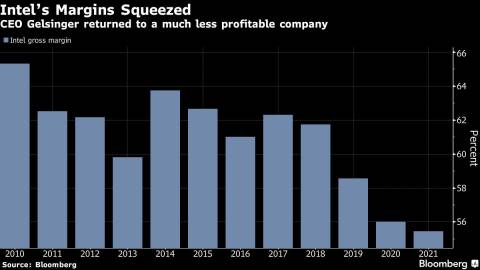

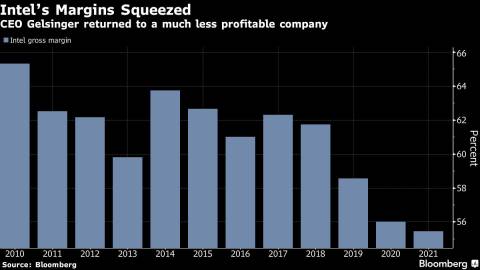

The company’s new target for 2022 revenue is $65 billion to $68 billion, a decline of as much as 13% from the prior year and a cut of as much as $11 billion from what it projected as recently as April. Gross margin will be 49%, 9.1 points narrower than a year earlier and 3 points shy of what the company had targeted.

Gelsinger’s push to restore Intel’s manufacturing prowess got a boost this week, when the US Senate and House passed legislation that includes $52 billion in grants and incentives for domestic semiconductor manufacturing. Intel, which has announced new plants in Arizona and Ohio in an attempt to compete directly with Taiwan Semiconductor Manufacturing Co., has told investors that government subsidies will help cushion the impact of the multibillion-dollar investments on its overall financial picture.

Earlier this week, market researcher Gartner Inc. slashed its prediction for overall semiconductor sales this year. Gartner also predicts PC shipments will drop 13% in 2022, and chip revenue from that market will shrink 5.4%. Other chipmakers, including Qualcomm Inc., have cited an unsteady economy and tepid consumer spending when giving less optimistic outlooks for earnings this year.

Read more: Gartner Slashes Chip Industry Forecast After PC Demand Slumps

Intel said gross margin, or the percentage of sales left after deducting production costs, will be 47% in the current period. That metric of profitability, once touted as an indication of Intel’s strength, was squeezed by increasing competition and is now more than 10 points narrower than the company’s annual gross margins for much of the past decade.

Gelsinger, who took over as Intel’s top executive in the first quarter of last year, has mapped out a strategy to return the company to its position at the forefront of the semiconductor industry and branch out into new markets. That initiative will massively increase Intel’s spending on manufacturing plants and equipment. Intel’s CEO says that’s now his priority over investor returns in the form of share repurchases.

Shareholders initially welcomed Gelsinger’s aggressive plans to make Intel’s products and manufacturing technology more competitive. More recently, investor concern has escalated about how much it may cost and how long it may take to win back market share lost to Advanced Micro Devices Inc., Nvidia Corp. and TSMC.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Ian King