(Bloomberg) -- Australia is on track for its steepest tightening of monetary policy in a generation, raising the risk of an economic slowdown as the housing market shifts into reverse and consumers pull back on spending.

The Reserve Bank of Australia will lift its key interest rate by 50 basis points for a third consecutive month on Tuesday to 1.85%, according to all but one of 23 economists surveyed. That will take its combined tightening since May to 175 basis-points, the biggest increase inside six months since 1994.

“The RBA is behind the pack,” said Andrew Ticehurst, senior economist and rates strategist at Nomura Holdings Inc. The current cash rate is “not appropriate for an economy with an unemployment rate at around a 50-year low and with core inflation running at a 6% annualized pace.”

Ticehurst sees the cash rate at 3.35% by year’s end while money markets are pricing in about 3%. Such a sharp pace of tightening will ratchet up loan repayments and weigh on consumption, which accounts for about 60% of economic output.

Policy makers are trying to rein in inflation that’s running at more than twice the upper end of the RBA’s 2-3% target. They maintain households can cope with further hikes because they built up savings during the pandemic and 3.5% unemployment means most Australians have incomes to meet their obligations.

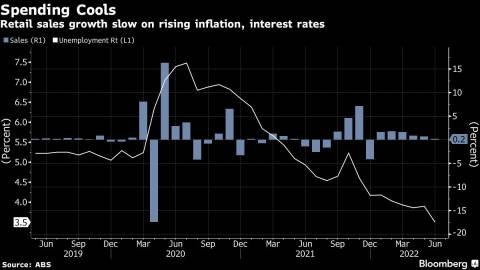

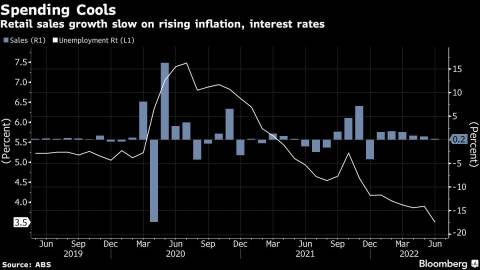

RBA rate increases flow through quickly to borrowers as most are on variable-rate loans. Figures last week showed early signs of cooling demand with retail sales in June rising at the weakest pace this year.

Commonwealth Bank of Australia internal data, which captures spending on credit and debit cards at the nation’s largest lender, showed a “clear easing” in consumption in July.

“There is a clear risk that the volume of household consumption falls by late-2022,” according to Gareth Aird, head of Australia economics at CBA. “We expect forward-looking indicators of the economy to slow sharply.”

Sliding house prices, which are directly linked to perceptions of wealth, are already weighing on consumer confidence. Real estate firm PropTrack expects prices to fall 15% from current levels in 2023, after climbing at an “exceptional pace” over the past two years.

That’s one reason Nomura, CBA, AMP Capital Markets and UBS Group AG predict rate cuts will come as early as next year.

The RBA will publish its quarterly update of forecasts on Friday that’s widely expected to show downgrades to economic growth and employment and a sharp increase in the inflation outlook -- in line with Treasury’s outlook last week.

The RBA doesn’t release its own projections for interest rates.

“We expect the labor market to start easing gradually later in 2023,” Felicity Emmett and Catherine Birch, senior economists at Australia & New Zealand Banking Group Ltd., said in a research note. “This will add to the case for the RBA to cut rates” in mid-2024.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Swati Pandey