(Bloomberg) -- Skeptics who are betting against MicroStrategy Inc.’s Bitcoin strategy are piling onto positions that the cryptocurrency company’s latest rebound will flame out.

A record 51% of MicroStrategy’s available shares are currently sold short, carrying a notional value of $1.35 billion, according to financial analytics firm S3 Partners. The all-time high of 4.73 million shares shorted has soared by 1.2 million shares over the past 30 days alone, S3 says.

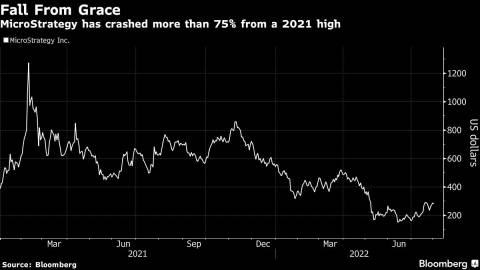

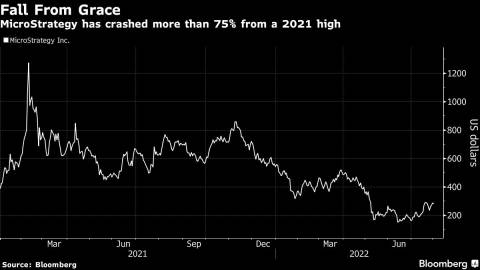

The tech company whose stock serves as a vehicle to invest in Bitcoin has erased more than three-quarters of its value from a February 2021 peak. The stock, which has rallied 73% from the end of June amid a broader risk-on trade, hasn’t closed above its 200-day moving average since December.

Short interest is up 680,000 shares over the past seven days showing that “it certainly looks like shorts are selling into the recent strength,” according to Matthew Unterman, a director at S3.

MicroStrategy is set to report second-quarter results after the market close on Tuesday. The stock fell 2.3% to $279.45 at 10:20 a.m. in New York, on pace to snap a three-day winning streak.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Bailey Lipschultz