(Bloomberg) -- Stocks in Asia face challenging conditions on Tuesday amid escalating US-China tension over Taiwan and deepening worries about a global economic slowdown, risks that are also driving a jump in bonds.

Futures pointed to muted starts in Japan and Australia and were more than 1% lower for Hong Kong. S&P 500 and Nasdaq 100 contracts wavered after July’s stock market rebound stumbled into August.

US House Speaker Nancy Pelosi is expected to visit Taiwan on Tuesday. She would become become the highest-ranking American politician to visit the island in 25 years. China views Taiwan as its territory and has warned of consequences if the trip takes place.

The offshore yuan and Chinese shares traded in the US retreated as reports of the likely visit emerged on Monday. Non-deliverable forwards on the Taiwanese dollar signaled a weakening of the island’s currency.

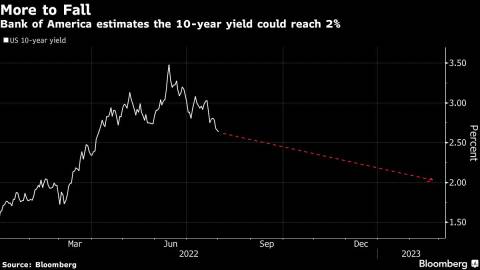

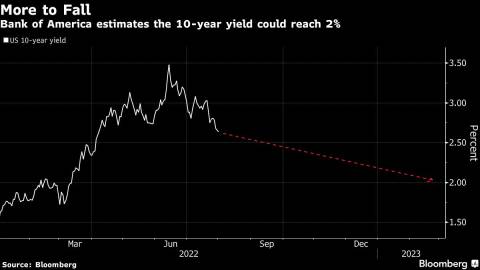

Treasuries climbed, lowering the 10-year yield to 2.57%, and a dollar gauge held losses. Bonds pushed higher in the wake of data suggesting factory output is shrinking or cooling in key economies alongside moderating input prices.

Investors are also keeping a wary eye out for more potentially hawkish comments from Federal Reserve officials about the need for higher interest rates to restrain elevated inflation.

Expectations for how aggressive the Fed must be have receded because of recession risk, so any shift in those perceptions could stoke market volatility.

“You’re going to continue to see a lot of the Fed-speak continue to be fairly hawkish,” Larry Adam, chief investment officer at the private client group at Raymond James Financial Inc., said on Bloomberg Television. But he expects easing inflationary pressures to allow the Fed to be “a little bit more accommodative as we head into the back half of the year.”

The prospect of a demand slowdown has sapped oil, leaving it around $94 a barrel. Oilseed and grain futures fell after the first grain ship since Russia’s invasion left Ukraine, heralding some relief for a tight global food market.

In Australia, the central bank is poised to lift borrowing costs for a fourth month, portending an economic slowdown in a campaign to get price pressures under control. The nation’s shorter-maturity bond yields advanced.

What to watch this week:

- Airbnb, Alibaba and BP are among earnings reports

- Reserve Bank of Australia rate decision, Tuesday

- US JOLTS job openings, Tuesday

- Chicago Fed President Charles Evans, St. Louis Fed President James Bullard due to speak at separate events, Tuesday

- OPEC+ meeting on output, Wednesday

- US factory orders, durable goods, ISM services, Wednesday

- BOE rate decision, Thursday

- US initial jobless claims, trade, Thursday

- Cleveland Fed President Loretta Mester due to speak, Thursday

- US employment report for July, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell were steady as of 8:06 a.m. in Tokyo. The S&P 500 fell 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.1%

- Nikkei 225 futures fell 0.4%

- S&P/ASX 200 futures lost 0.3%

- Hang Seng futures declined 1.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was at $1.0263

- The Japanese yen was at 131.60 per dollar

- The offshore yuan was at 6.7822 per dollar

Bonds

- The yield on 10-year Treasuries declined eight basis points to 2.57%

- Australia’s 10-year yield fell three basis points to 3.03%

Commodities

- West Texas Intermediate crude was at $93.81 a barrel

- Gold was at $1,772.10 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Sunil Jagtiani