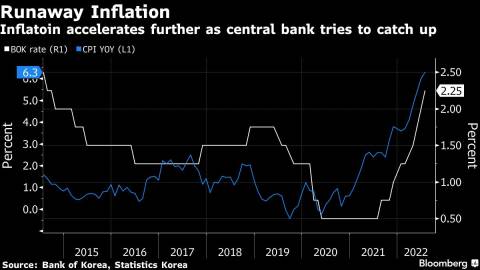

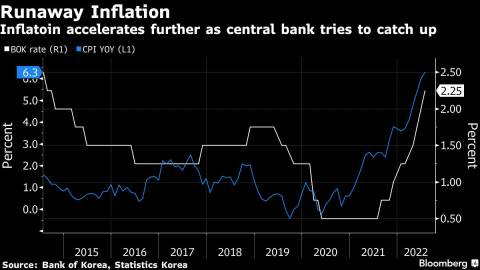

(Bloomberg) -- South Korea’s inflation accelerated further in July, underscoring the central bank’s need to keep raising interest rates to try to rein in mounting price pressures.

Consumer prices advanced 6.3% from a year earlier, quickening from 6% in June and matching estimates, government data showed Tuesday. Governor Rhee Chang-yong said a day earlier that the Bank of Korea will likely raise rates by 25 basis points this month, while declining to rule out a bigger increase.

Korean policy makers expect price growth will remain elevated for a few months before beginning to decelerate. Risks to that outlook include an intensification of Russia’s war on Ukraine or a flaring of other geopolitical flashpoints.

The central bank will scrutinize today’s report as it prepares for a rate decision on Aug. 25. Policy makers hiked by a half-percentage-point last month, joining global counterparts including the Federal Reserve in opting for outsized increases.

Rising consumer prices have added pressure to wages, spurring disputes between workers and employers in some of the country’s key industries such as automobiles and shipbuilding.

“Pressure on the BOK to raise rates, like the Fed, again will be strong if previous hikes fail to suppress wage growth and oil prices rise again,” said Lee Seung-suk at the Korea Economic Research Institute. “Inflation has been causing wages to increase and now wages will start to fuel inflation.”

He estimates inflation increases 0.6% for every 1% rise in wages.

A year into its tightening cycle, the BOK is increasingly wary of risks to the economy, including the potential for a global recession as the Fed intensifies rate increases and Russia’s war keeps energy prices elevated.

Covid lockdowns in China are also piling stress on international supply chains and weakening demand for Korean products.

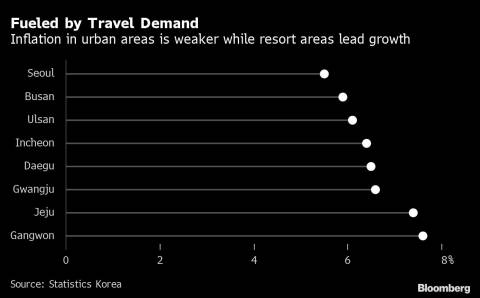

Korea’s inflation is proving stronger in sectors and regions where consumers are releasing pent-up demand following the easing of virus restrictions that made it difficult to travel and dine out. The trade-reliant economy expanded last quarter even as exports cooled, with consumption helping prop up activity.

Today’s inflation report also showed:

- Compared with the prior month, consumer prices rose 0.5% in July

- South Korea’s core inflation came in at 4.5%, versus the prior year

- Transportation costs rose 15.3%. Food and beverage prices increased 8%. The price of household goods and services climbed 5.1% from a year earlier

- Prices at hotels and restaurants jumped 8.3%. Costs of entertainment and cultural products increased 3.1%.

- Gangwon province, a popular travel area along with Jeju island, led the growth among regions, seeing prices rise 7.6%. Inflation in Jeju came at 7.4%. Seoul saw the smallest increase at 5.5%.

(Adds economist’s comments, new chart.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Sam Kim