(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Australia’s central bank gave itself wriggle room to amend its interest-rate path if the economic outlook deteriorates after implementing the sharpest policy tightening in a generation.

“The board expects to take further steps in the process of normalizing monetary conditions over the months ahead, but it is not on a pre-set path,” Governor Philip Lowe said after raising rates by 50 basis-points for a third straight month. The “size and timing” of future hikes will be “guided by the incoming data.”

The currency declined and bonds rallied as the market interpreted Lowe’s statement as an echo of Federal Reserve chief Jerome Powell’s move to give himself more flexibility on policy.

Yields on the 10-year government bond tumbled by 10 basis points to 2.95%, the Australian dollar fell below 70 U.S. cents and the benchmark stock index erased losses.

“While the language and sentiment are not new, the emphasis appears a little stronger in laying the groundwork back to a more modest pace of tightening,” said Su-Lin Ong, chief economist for Australia at Royal Bank of Canada.

The RBA has rapidly tightened policy, having raised by 175 basis points since May, joining global counterparts from Washington to Wellington in trying to prevent consumer prices spiraling out of control. Headline inflation in Australia last quarter was running at twice the top end of the central bank’s 2-3% target.

The RBA provided some forecasts from its quarterly update due to be released on Friday. It sees:

- Inflation around 7.75% over 2022, a little above 4% over 2023 and around 3% over 2024

- GDP growth of 3.25% over 2022 and 1.75% in each of the following two years

- The central forecast is for unemployment to be around 4% at the end of 2024

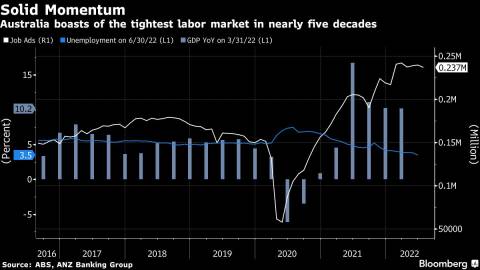

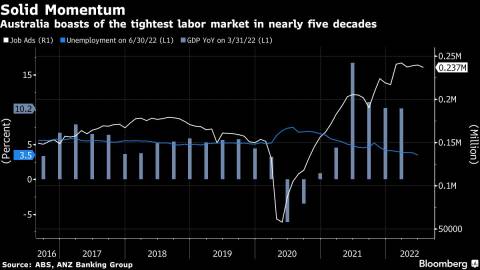

Lowe is confident the economy can cope with the sharpest tightening cycle in a generation as households remain cashed up from pandemic-era stimulus and unemployment is at a 48-year low of 3.5%.

“How household spending holds up against a backdrop of higher inflation and falling house prices -- the negative wealth effect -- versus savings and wealth buffers” will be crucial to “how high and fast the cash rate rises,” said Eleanor Creagh, senior economist at PropTrack.

“This dynamic will also be a key source of uncertainty for the housing market and the pace and depth of price falls,” she said.

Higher rates feed straight through to Australian borrowers, most of whom are on variable-rate mortgages. The RBA has signaled it’s trying to get the cash rate to around 2.5%, or a neutral level, while money markets are pricing in 3.1% by the end of the year.

(Adds RBA forecasts, market reaction.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Swati Pandey