(Bloomberg) -- A bout of jitters in global markets over deepening US-China tension weighed on cryptocurrencies, pushing Bitcoin lower for a third day.

The largest digital token fell as much as 1.6% to $22,769 on Tuesday and was trading at $22,860 as of 2:57 p.m. in Tokyo. Ether at one point shed 3.7%, while smaller coins ranging from Polkadot to Cardano were also in the red.

US House Speaker Nancy Pelosi is set to land in Taiwan on Tuesday and would be the highest-ranking American politician to visit in 25 years. China views the island as its territory and has warned of consequences if the trip happens. The risk of escalation led investors to dump stocks and US equity futures.

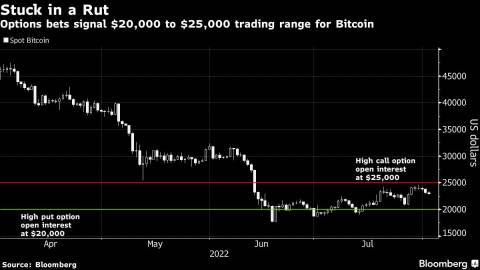

Before the latest gyrations, Bitcoin made a weekend run toward $25,000 on the way to rounding out its best monthly gain since October last year. The climb has encouraged the view the worst of this year’s crypto rout -- Bitcoin is down about 51% -- is in the rear-view mirror.

Bets in the options markets suggest speculators see $25,000 as a ceiling for Bitcoin and $20,000 as a floor. This is because of a high number of outstanding call and put contracts -- so-called open interest -- at those strike prices respectively, according to data compiled by Coinglass.

For Craig Erlam, senior market analyst at Oanda, Bitcoin’s rebound last month had “all the feeling of a bear-market rally as we may be seeing in equity markets.”

“That doesn’t mean it won’t have further to run,” he wrote in a note.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Joanna Ossinger