(Bloomberg) -- Toronto-Dominion Bank agreed to buy US brokerage Cowen Inc. for $1.3 billion in cash, bulking up its presence in American capital markets just months after striking a historic deal to expand its retail operations in the country.

Toronto-Dominion agreed to pay $39 a share, according to a statement Tuesday. The acquisition is likely to be “modestly accretive” to adjusted earnings per share next year, the Toronto-based company said. Bloomberg News reported last month that the bank was weighing the deal.

In purchasing Cowen, Canada’s second-largest bank is addressing its relative weakness in the capital-markets business relative to larger competitors such as Royal Bank of Canada and helping cushion the company from potential downturns in its retail-banking operations. The deal also further deepens Toronto-Dominion’s reach into the US, along with its planned $13.4 billion acquisition of First Horizon Corp., announced in February.

“Cowen is a leading independent dealer with a premier US equities business and a strong, diversified investment bank that, when combined with TD Securities, will allow us to accelerate our strategic US growth plans,” Toronto-Dominion Chief Executive Officer Bharat Masrani said in the statement.

Toronto-Dominion’s wholesale-banking business accounted for about 11% of the company’s fiscal 2021 revenue. That compares with the roughly 21% that Royal Bank generated from its capital-markets division.

Cowen, which went public in 2006, saw its net income soar 38% year-over-year to $289 million in 2020 amid a record year for initial public offerings. In the past 12 months, it has acted as a bookrunner on 55 IPOs, serving as the lead adviser on five of the listings, according to data compiled by Bloomberg.

The brokerage’s shares rose 7.9% to $38.31 at 7:49 a.m. in early New York trading.

With mergers in Canada’s highly concentrated banking sector blocked by regulators, Toronto-Dominion has long looked south for expansion. The firm entered US retail banking with the $3.8 billion purchase of 51% of Banknorth Group Inc. in 2004. Three years later, Toronto-Dominion doubled its US presence with the $8.34 billion acquisition of Commerce Bancorp Inc.

Toronto-Dominion had more than 1,100 US branches at the end of its most recent fiscal year, and it stands to gain about 400 more when its purchase of First Horizon is completed. That deal would expand Toronto-Dominion beyond its East Coast footprint into markets such as Tennessee, Louisiana and Texas.

With the Cowen acquisition, TD Securities will add the New York-based firm’s 1,700 employees, bringing the total to 6,500 people in 40 cities worldwide. The deal has been approved by the boards of both companies and is expected to be completed in the first quarter of next year.

Cowen Chair and CEO Jeffrey Solomon will join the senior leadership of TD Securities, reporting to unit President and CEO Riaz Ahmed, and parts of the combined business will be known as TD Cowen, to be headed by Solomon.

Schwab Sale

To provide capital for the purchase, Toronto-Dominion sold 28.4 million non-voting common shares of Charles Schwab Corp. for about $1.9 billion, reducing its ownership stake in the company to about 12% from 13.4%. Toronto-Dominion said it “has no current intention to divest additional shares” in Charles Schwab.

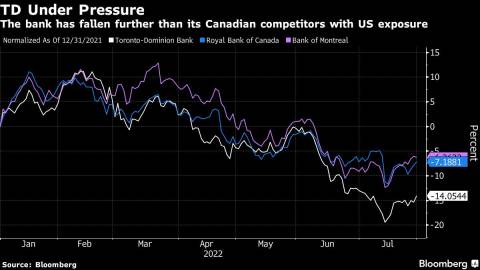

Toronto-Dominion’s shares have underperformed those of two main Canadian peers with big US presences -- Royal Bank and Bank of Montreal -- amid doubts that it will be able to complete its takeover of Memphis, Tennessee-based First Horizon. Toronto-Dominion shares had slumped 14% this year through Friday, more than Royal Bank’s 7.2% decline and Bank of Montreal’s 6.3% drop, and the worst performance among Canada’s six largest banks.

“There has been quite a bit of underperformance for TD, and you can attribute the majority of that to what’s been happening on the regulatory front,” Stifel Financial Corp. analyst Mike Rizvanovic said in an interview before the Cowen deal was announced. “When you think about TD’s dynamic on where they make money and where they could deploy capital, if you’re on the wrong side of US regulators, it’s certainly not a good thing because it is such an important market for them.”

President Joe Biden signed an executive order in July 2021 -- seven months before Toronto-Dominion announced the First Horizon deal -- that urged regulators to more heavily scrutinize bank mergers as part of a broader push to increase competition in the country. In June, Senator Elizabeth Warren asked regulators to block the deal, citing concerns with the bank’s practices after the Capitol Forum reported that Toronto-Dominion wrongly pressured customers into opening certain accounts. Toronto-Dominion has said the allegations are “completely unfounded.”

As for the First Horizon deal, “the regulatory approval process is on track, and we remain confident that we will complete the transaction” in the first quarter of fiscal 2023, spokeswoman Lisa Hodgins said in an emailed statement. The transaction “creates value for both organizations, employees, customers and the communities we serve,” with community leaders from regions served by the two banks having sent more than 300 letters in support of the merger to regulators, she said.

(Updates with deal details, background on First Horizon starting in ninth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Kevin Orland and Stefanie Marotta