(Bloomberg) -- European natural gas prices advanced for a second day as traders seek clarity on supplies from Russia and the pace of demand destruction in the region.

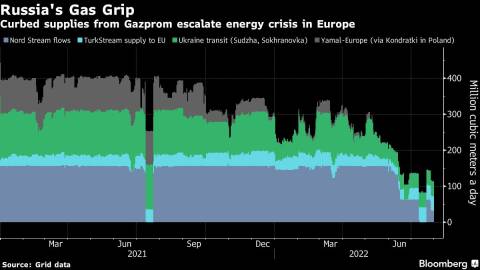

Benchmark futures remain above 200 euros per megawatt-hour after Russia’s Gazprom PJSC curbed flows on the key Nord Stream pipeline last week to about 20% of capacity. Flows through the link have been fluctuating near, and even below, that level since the weekend.

Russia cut exports to Europe to multiyear lows this summer -- supplying less than a third of normal volumes -- and there’s no clarity on further moves.

The curbs have driven prices to their highest since early March, during the first weeks of Russia’s invasion of Ukraine. Soaring energy bills have fanned inflation, threatening to tip parts of the continent into recession, as nations rush to stockpile gas ahead of the winter months.

Russian Gas Flows Via Nord Stream Edge Lower on Tuesday

Supply shocks are affecting heavy-manufacturing companies that rely on the fuel.

Germany’s Covestro AG, a provider of high-tech polymers, warned of further risks to its facilities and the sector if gas flows are rationed.

“Due to the close links between the chemical industry and downstream sectors, a further deterioration of the situation is likely to result in the collapse of entire supply and production chains,” the company said in an earnings statement Tuesday.

European gas storage facilities are about 69% full, with the pace of refilling at average levels despite the cuts. Volumes of Russian supply in the weeks ahead -- plus the European Union’s ability to reduce consumption and buy liquefied natural gas amid competition from Asia -- will determine if enough fuel can be stored for the cold season.

Publicly, Moscow claims that issues with equipment at Nord Stream’s entry point in Russia, along with maintenance delays caused by international sanctions, forced it to slash supply in several steps since June. However, Kremlin insiders have said privately that the cuts are meant to pressure the EU over sanctions and its support for Ukraine.

EU nations are quickly lining up alternative supplies and import infrastructure. The Netherlands will receive the first LNG delivery into its second terminal as early as mid-September, according to network operator Nederlandse Gasunie NV. Two floating units for the project in Eemshaven will arrive next month, and capacity already is sold out.

In France, a floating LNG terminal at Le Havre will start from September 2023, sending the equivalent of about 60% of Russian gas imports last year into the French grid.

Dutch front-month gas contract, the European benchmark, rose 2.2% to 205.174 euros per megawatt-hour in Amsterdam, after gaining 5.2% Monday. The UK equivalent increased by 3.5%.

“If Russian flows halt entirely, which is not out of the question, prices will skyrocket further,” said Karolina Siemieniuk, an analyst at Rystad Energy. “A serious gas shortage in one of the biggest European economies could cause a major economic crisis in the country and negative impacts on other EU member states.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Elena Mazneva and Anna Shiryaevskaya