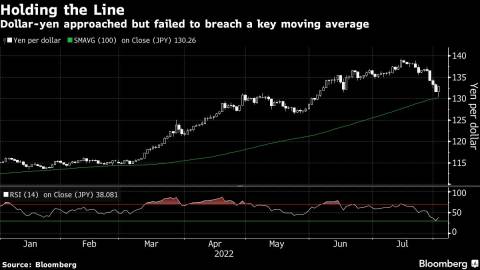

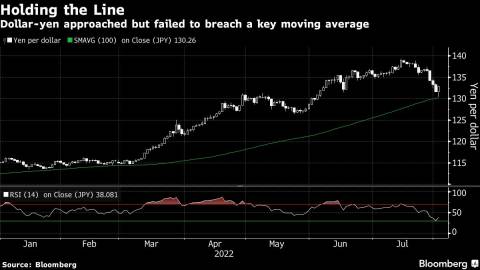

(Bloomberg) -- The dramatic recovery staged by the Japanese yen over the past week looks to be coming to a sputtering halt, keeping intact for now a key resistance level that’s held firm throughout this year.

The yen on Monday chalked up its strongest four-day run since the early days of the Covid pandemic and was on course for a fifth daily gain on the back of rising geopolitical concerns in Asia before an abrupt turnaround in risk sentiment that’s seen Treasury yields surge and the dollar along with them. The arrival of US House Speaker Nancy Pelosi in Taiwan, whose imminent visit had been fueling risk aversion, was accompanied by a recovery in investors’ risk appetite even as China outlined various measures in response.

The dollar-yen exchange-rate rose as much as 1.2% Tuesday to 133.18 amid bouts of short covering. It earlier fell as much as 0.9% to 130.41, just above the 100-day moving average for the pair. That average has acted as something of a support for the dollar -- or resistance from the perspective of the yen -- throughout 2022.

Federal Reserve officials reminding markets that they remain on course to raise rates appears to have brought focus back to fundamentals.

“While China’s reaction has been relatively restrained, it remains unclear and tension is expected to linger, but market focus is now on volatile US yield moves and the uncertainty of their direction, with choppy trading expected until Friday’s nonfarm payrolls,“ said Yukio Ishizuki, a senior currency strategist at Daiwa Securities in Tokyo.

Over the long term, dollar-yen has closely tracked the yield spread between US and Japanese government bonds, with the correlation showing signs of tightening again after some widening in last month.

The Asian trading session on Wednesday may provide some insight as to whether this latest direction will be maintained or not, as those hours have tended to be when the biggest episodes of yen buying have taken place during the past week.

The pair slipped 0.1% to 133.07 at 7:58 a.m. in Tokyo on Wednesday.

Tuesday’s moves followed a four-day drop of close to 4% for dollar-yen that took the pair into territory that, based on relative strength indexes, some traders would consider oversold. That move was part of a broader reversal that saw the pair pull back from a peak of 139.39, a multi-decade high, as haven buying helped fuel appetite for the Japanese currency.

And in another worrisome sign for yen bulls, demand for yen calls in the options market is signaling traders aren’t positioning for further gains. One-month risk reversals, 1.3% in favor of yen calls, have moved only marginally over the past week.

(Updates with Wednesday’s price and quote.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Robert Fullem