(Bloomberg) -- Extreme hot weather has exposed flaws in England’s water system -- and could make it harder for the country’s unpopular, privatized utilities to borrow money on the public markets.

UK water companies normally issue new bonds in the second half of the year, as firms return to debt markets after a summer slowdown. This year, however, investors are ready to demand higher yields, especially for providers lagging behind on their leakage targets.

As much as three billion liters leaks from Britain’s water system every day, equivalent to the average usage of nearly 30% of the UK, prompting public anger at the bonuses and high salaries paid to utility giants’ bosses. A drought was officially declared across much of England last week and millions of families have been hit by restrictions on their water usage.

“I would expect the worst offenders to be punished in the primary market and they will have to price with an attractive new issuance premium to keep investors on side,” said Johnathan Owen, a portfolio manager at TwentyFour Asset Management in London. Investors will focus on the “best in class going forward,” he said.

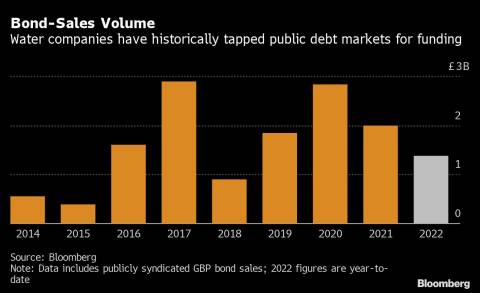

The expected increase in the cost of capital represents yet another blow for the likes of Thames Water Ltd. and Southern Water Ltd. that often rely on debt markets to fund operations. This year alone, water companies sold £1.4 billion ($1.7 billion) of new debt, accounting for about 10% of all UK company bond sales.

Political Sensitivities

Three-quarters of water companies are meeting targets to reduce leaks, the industry regulator, Ofwat, said in late July. However, it added that “there is more that can be done.”

Thames Water has cut leaks by more than 10% in the past two years, Ofwat said, but Southern Water and South East Water were further behind at 5% and 3.3%, respectively.

The leaks have attracted criticism from politicians. Liz Truss, the front-runner to become the next Conservative leader and prime minister, said she would “make sure water companies are held to account,” while Rishi Sunak, her rival in the leadership race, said that it’s “not acceptable if we have an enormous amount of water wasted through leakage and indeed polluting our rivers. That’s just not right.”

The Environment Agency said last month that water companies’ environmental performance was “the worst we have seen for years,” following public outrage at the amount of raw sewerage that ended up in rivers.

It added: “The water companies are behaving like this for a simple reason: because they can. We intend to make it too painful for them to continue as they are.”

A recent poll showed that 69% of Brits think water provision should be a public sector operation, with just 19% supporting the private sector’s role.

“Water companies are tightly regulated by governments and regulators who are sensitive to public opinion,” said Graham Taylor, senior vice-president at Moody’s project infrastructure finance group.

“If a narrative takes hold that the companies are excessively profitable, underinvesting, to blame for water shortages, or delivering poor environmental outcomes, regardless of whether that perception is fair, we could see credit-negative changes to regulatory frameworks,” he said.

Funding Costs

Earlier this year, a sustainability bond for Severn Trent Plc paid investors about 18 basis points of new issuance concession, according to Bloomberg calculations. The premium was in line with the broader sterling market at the time.

Since then, funding costs have spiraled as the Bank of England raised interest rates further to rein in inflation and Russia’s invasion of Ukraine disrupted supply-chains and tipped Europe toward a recession. Since then, not a single UK water provider has sold debt in Europe’s market.

Southern and Severn Trent didn’t reply to emailed and telephone requests for comment. Thames Water declined to comment.

Whoever is to blame, negative headlines around leaks have already drawn scrutiny to water companies’ use of the debt markets.

“I expect management to bring the issues to the forefront to assuage investor concerns on what they are doing to address the shortfalls,” said Robert Lambert, a credit analyst at Bluebay Asset Management LLP. Still, he said, investors will remain happy to lend to water companies -- albeit at a higher premium.

Despite the drought and increasing political pressures, the water industry “benefits from megatrends such as population growth and improving critical infrastructure,” Lambert concluded.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Priscila Azevedo Rocha