(Bloomberg) --

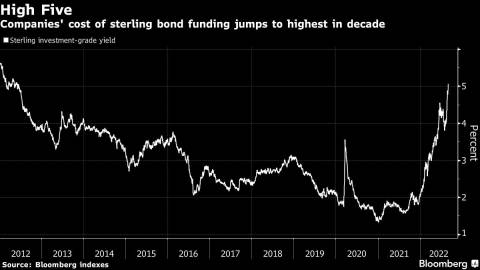

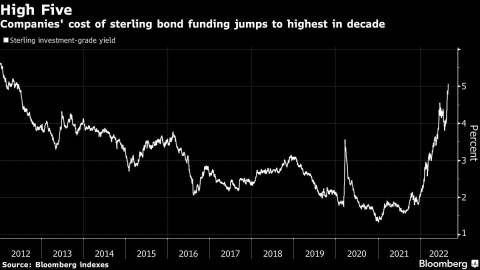

Borrowing costs for blue-chip British companies have risen past a key threshold for the first time in more than a decade, as runaway inflation hammers the country’s corporate sector.

An index of investment grade sterling bonds was quoted at a yield of 5.007% on Aug. 31, the highest level since May 2012 and more than double what it was at the start of the year.

That means companies face paying roughly £1.4 million ($1.6 million) more for every £100 million raised in the bond market compared to the current yearly average, based on Bloomberg indexes. For bondholders, the rate increase translates to a total return loss of more than 17% so far this year.

With lackluster wage growth and soaring energy prices hitting households, investors are concerned that Britain is in for a rough ride. Inflation hit a 40-year high in the UK in July, fueling bets of further rate hikes from the Bank of England. The Resolution Foundation warned of a 10% fall in real disposable incomes over two years, the biggest drop in living standards in a century.

Last month the BOE unleashed its biggest interest-rate hike in 27 years and warned the UK is heading for more than a year of recession. It sees inflation peaking at more than 13%. Economists at Goldman Sachs Group Inc. warn it could top 22% if natural gas prices remain elevated in coming months.

Investors fear that further central bank rate hikes -- needed to bring down price growth -- would deepen Britain’s economic troubles, leaving the country worse off compared with the US and the euro region.

“We’re short UK versus EU risk at the moment,” said Kamil Amin, a credit strategist at UBS Group AG. “There is the risk of the Bank of England doing more rather than less compared to the ECB to tackle inflation,” he said, adding that the UK is at greater risk of a deeper recession.

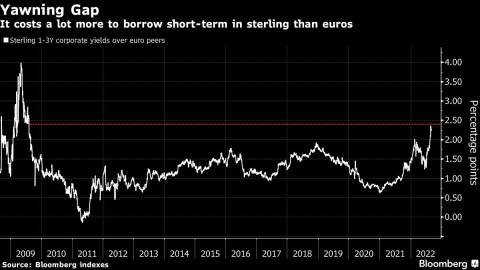

In a sign of the UK’s precarious state, the gap between the yields of sterling-denominated corporate bonds and their euro counterparts is getting bigger, especially in the short maturities where the influence of policy rates is at its strongest.

Sterling notes maturing within one to three years now yield almost 2.4% more than similarly-dated euro bonds; their highest pick-up in 13 years, according to Bloomberg indexes. The yield gap has been widening in longer-dated notes too.

The BOE has been far ahead of the European Central Bank when it comes to policy tightening, having started hiking rates last December. It has already lifted its benchmark rate from a record low of 0.1% to a post-2009 high of 1.75%. It has also published plans to reverse purchases of government and corporate bonds.

By contrast, the ECB lifted its own interest rates for the first time in more than a decade only in July and plans to maintain its current level of bond holding after it stopped adding to the various QE programs this summer. Policy rates in the euro area are set to remain well below the UK’s even after traders fully priced in a 75-basis-point hike by October.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Abhinav Ramnarayan and Tasos Vossos