(Bloomberg) -- When binge-watching TV became a universal pastime at the height of the pandemic, one of Europe’s top officials called the Chief Executive Officer and co-founder of Netflix Inc. and told him to make his product worse.

Internal Market Commissioner Thierry Breton wanted Netflix to reduce the quality of its videos to free up bandwidth, fearing that Europe’s networks were under strain. Reed Hastings complied, cutting data output by about 25% for a month. So did YouTube.

It didn’t matter there was little evidence that networks were overloaded, or the fact Netflix already adapts video quality based on the capacity of the network it’s on. Politicians were alarmed at the prospect that millions of miles of cables and tens of thousands of antennas under their jurisdiction might be at the mercy of Silicon Valley, right when Europe became reliant on internet access to live and work through Covid-19 lockdowns.

So the European Union waded into an argument local broadband operators had been making for a decade: should Big Tech chip in for the telecom infrastructure they use?

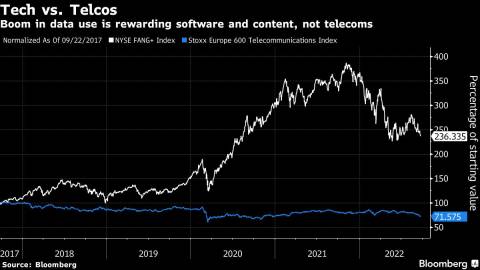

Broadband operators argued that the rewards from suddenly carrying 40% more downstream traffic and double the upstream traffic during the pandemic went to US tech platforms, while they were stuck footing the bill. The Stoxx 600 Europe Telecommunications Index has lost a quarter of its value in the last five years, while the NYSE FANG+ Index tracking the biggest tech stocks has more than doubled.

Now policymakers are beginning to share the carriers’ fears that if Europe continues to leave all the investment to telecom operators, its digital grid and the businesses built on top could fall behind those of the US and Asia.

“It’s time to see if our regulation and organization of the infrastructure supporting our digital space is relevant or not,” Breton said in an interview with Bloomberg this month. One of the questions, he said, includes “who should pay what.”

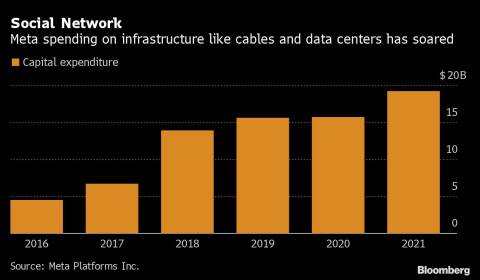

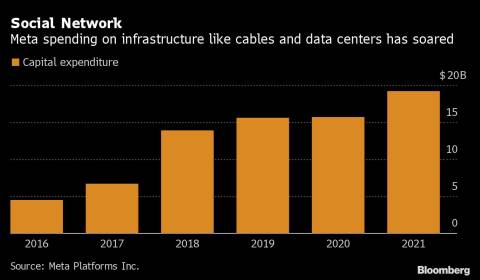

Tech companies are quick to rebut these arguments. They do invest in infrastructure: Meta and Alphabet have spent billions of dollars laying underwater cables between continents, adding tens of billions of dollars to Europe’s economy, according to research funded by Meta. Netflix has installed thousands of server boxes in more than 700 EU cities, to compress and store video locally so it doesn’t jam networks. In a push to get more people connected to the internet - and Facebook - Meta Chief Executive Officer Mark Zuckerberg has backed tools and initiatives to speed up telecom rollouts.

“We partner with European internet service providers to make networks more efficient,” said a Netflix spokesperson. “We operate more than 700 caching locations in Europe, so when consumers use their internet connection to watch Netflix, the content doesn’t travel long distances. This reduces traffic on broadband networks, saves costs, and helps to offer consumers a high-quality experience.”

Matt Brittin, Google’s President of EMEA, said at an event in Brussels that it’ll be customers who pay “either with price or pay in worse services,” if Europe adds a streaming fee.

For a few years, telecom companies and suppliers were themselves the hottest stocks, offering consumers the latest gadgets. Millions paid to send texts on Nokia phones branded with Orange and Vodafone logos.

But after the launch of the iPhone in 2007 and the rise of social media, the ground began to shift. The likes of BT Group plc spent billions laying fiber optic cables and installing antennas so their customers could continue downloading apps and streaming videos from other companies.

Large countries like France, Spain and Italy, as well as key European parliamentarians, back the push to make streaming sites like Netflix and YouTube pay their “fair share” to support infrastructure upgrades. But other influential countries like Germany, Denmark and the Netherlands are warier. Even some who back the general concept don’t know how to make it work. Some officials are asking whether the issue is Big Tech’s lack of investment, or rather the fragmentation of the telecom market itself.

In the US, there are now just three big mobile companies, while the EU contains nearly 40 large players, whose mergers have been blocked, making it nearly impossible to keep up, the telcos argue. That’s sparked concerns Europe might fall behind: just 2.5% of mobile connections were over 5G in Europe in 2021, versus 14.2% in the US and 28% across China, Japan and Korea, according to GSMA Intelligence, the research arm of the global mobile trade group. In time that could mean losing out on the next big 5G startup, or industrial investments, operators say.

“We have to consider that telco markets in Europe are much less attractive than in the US,” said Germany’s Andreas Schwab, who led the Digital Markets Act negotiations in the European Parliament. “This is a problem that we have to deal with as the 5G expansion is needed,” adding there is “no doubt that some non-telcos have a huge business” running on telecom operators’ networks.

Europe’s biggest telecom operators like Vodafone constantly talk about the need for consolidation – and the EU’s appetite to allow it will now be tested anew with the planned merger of Orange SA and Masmovil in Spain.

Ideas include making companies pay for the amount of data they use; creating a fund – possibly overseen by governments – to invest in infrastructure; or – in a proposal supported by Spain’s Telefonica – requiring tech companies to negotiate deals directly with the carriers.

“This is not a question of ‘you big American platforms, please be generous to us, because you are so huge,” Telefonica’s head of public policy Juan Montero Rodil said in an interview. “Not at all. What we are speaking about is paying a price for a service we deliver.”

Only a handful of firms are in the phone companies’ sights: Britain’s BT said that four-fifths of the data clogging their cables can at times be driven by just four companies, in a submission to digital regulator Ofcom, which is reviewing net neutrality rules aimed at ensuring internet service providers do not control what users can and cannot see on the internet. The review is also looking at investment incentives.

A report commissioned by Europe’s telecom lobby group ETNO found that 56% of global traffic from 2021 was generated by Google, Meta, Netflix, Apple, Amazon and Microsoft.

Although experts question how accurately companies can determine where data comes from, it’s clear that usage is only likely to increase. And more fonts of data continue to flood in: TikTok traffic over BT’s network has grown twenty-fold in the last year, the company said. Representatives for TikTok didn’t immediately respond to a request for comment.

For now, European carriers are avoiding lawsuits like SK Broadband Co, in South Korea, which sued Netflix claiming the rush to watch hit show Squid Game meant the streamer should be liable for millions of dollars in higher network costs. Korea also passed a so-called Netflix Law which holds online content providers accountable if they fail to maintain stable services, according to local news agency Yonhap.

BT executive Marc Allera likened a ‘fair use’ payment to how Netflix still pays to ship thousands of DVDs to old school subscribers.

“Net neutrality applies a set of regulation over what should be a free state to operate in the way you see fit,” he said in an interview. On the responsibility of big tech platforms, he asked: “Do they have any stake in the game, any contribution to make to these once-in-a-generation networks that are effectively creating all of the value and usage for them?”

“I think there is a role greater than what it is today – which is close to zero.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Thomas Seal and Jillian Deutsch