Cashless P2P (peer-to-peer) transaction apps are great and have unequivocally made our lives easier, but as is the case with any emergent technology, scammers are quick to find ways to exploit them for ill-gotten gains.

Unlike other low-level financial crimes, where your account is fraudulently accessed, spammers using Zelle and other payment apps rely on you voluntarily sending the funds to them. And since it’s hard to prove their wrongdoing when you’re the one who made the decision to pay them, you’re unlikely to have Zelle reverse the transaction once you realize you’ve been had. Zelle even goes so far as to explain the difference between fraud and scams on their site and explain why your consent to the transaction limits their ability to reverse it. Essentially, once that money’s sent, it’s gone, so your first and strongest line of defense is you.

By honing those critical thinking skills and keeping your guard up for red flags, you can almost always avoid losing money to one of these crafty social engineers.

Yes, even MLB announcers can get caught in the Zelle scammer’s trap.

Think rationally

Calling them Zelle scammers is somewhat of a misnomer, since the scamming action usually takes place on another messaging app like Telegram or WhatsApp. Zelle is merely the wallet-draining terminus a scammer is trying to lead you to. So if you never reach the point of opening your Zelle app, the scammer can never succeed.

As a rule of thumb, avoid responding to unsolicited texts and emails whenever possible. Any random message from an unknown or unverified source that’s asking something of you should immediately raise your guard. It doesn’t matter if they’re asking you to send money over Zelle or just click on a link. The mere presence of this out-of-the-blue request should set off alarm bells.

The Zelle scammer strategies

Zelle scammers manipulate people's emotions with lies to get their money. Fear, compassion, and excitement are the main levers they pull. Here are a few examples from each of those categories to look out for, and why they’re bunk.

A scammer claiming to be from a utility company threatens to shut off a service if you don’t pay within the next few minutes. Your utility company will never do this.

A scammer claiming to be from your bank alerts you to a breach into your account. While banks do often reach out when a customer’s account has been breached, they would never ask you to offer up passwords or send them money over a third-party app when that has transpired. Log into your account the normal way or call the bank’s phone line if you’d like to confirm everything’s OK.

A scammer claiming to be a friend or family member in a financial bind reaches out from a new number because their old phone was lost or stolen. Hey, it’s great to want to help out a loved one in a tough spot. But would your friend or family member really do this? If you’re feeling generous, first try contacting the person on their normal “lost” number or via social media and asking them something only the real person would know to confirm their identity before you even think about sending them money.

A scammer claiming to be selling puppies says they only take payment up front and via P2P app. As the American Kennel Club notes, these offers seem too good to be true because they are. Logic can often take a back seat when people have their heart set on finding the perfect pup. The images in the ads are usually stock photos, because the dog you’re attempting to buy doesn’t exist.

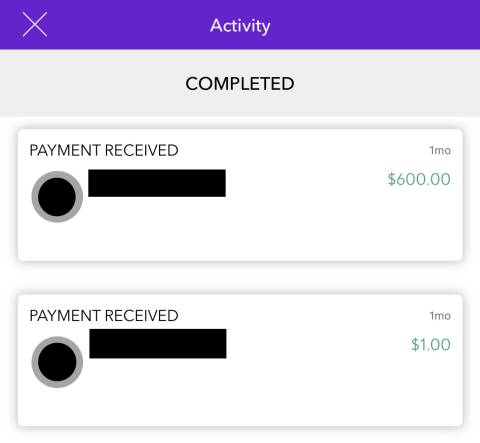

Credit: Screenshot: Zelle

If you have to use Zelle anyway…

Even when properly filtering for scammers, legitimate occasions may arise that require you to send funds to a stranger via a payment app. Here are some protocols to help you safely complete these transactions: First, double check that you have the right number, email, or person. For larger transactions, it’s wise to next send a $1 “test” to that account. You may also wish to sign up for multi-factor authentication wherever possible as an added layer of security.