(Bloomberg) -- Chinese stocks rebounded within minutes of opening lower on Monday, as gains in tech and property shares offset disappointment from a reiteration of the Covid Zero strategy by health officials.

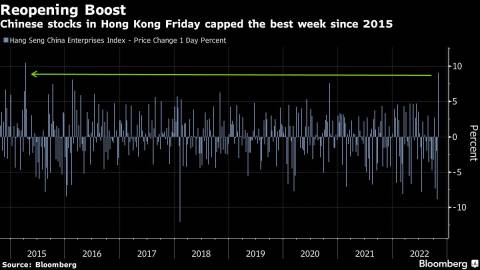

The Hang Seng China Enterprises Index climbed as much as 4.2% Monday morning, extending gains after capping its best week since 2015. A separate gauge of Chinese tech stocks in Hong Kong jumped more than 5%. The offshore yuan weakened 0.4% against the dollar after a 2% surge on Friday.

While officials at the National Health Commission sought to dispel wild rumors over the weekend, the reopening speculation has offered just the excuse that weary traders needed to buy stocks after suffering months of losses. Broader gauges in Hong Kong climbed even as reopening names fell, as investors snapped up tech and property shares -- ones that have been beaten down the most in this year’s relentless selloff.

Read: Greater China Stocks Love Reopening Even If It’s a Myth

“Sentiment on Chinese stocks is so low that any potential catalyst would send stocks racing,” David Chao, global market strategist for Asia Pacific ex-Japan at Invesco Ltd. “Pent-up money sitting on the sidelines is chasing this rally. If you look at the stocks that have benefited, it’s the large-cap tech stocks and I’m not surprised.”

Tech stocks rose again after a dizzying rally on Friday, when Bloomberg News reported progress in efforts to prevent the delisting of hundreds of Chinese stocks from US bourses.

Some sectors related to reopening, including airlines and tourism shares, were down Monday, paring some of last week’s surge. Air China Ltd. and China Southern Airlines Co. were down about 1% as of mid-day trading break on the mainland, while China Tourism Group Duty Free Corp. slumped 2%.

Still, investors say comments from Chinese health officials were insufficient to completely douse hopes of a Covid Zero exit. While they said China will “unswervingly” adhere to its current Covid controls, excessive Covid restrictions in some cities were criticized, prompting Zhengzhou to pledge to take targeted Covid measures.

“Although the press conference thwarted some hopes of a faster reopening, there have been adjustments at the local level to avoid excessive Covid restrictions, which investors could consider as a slight positive,” said Shen Meng, a director at investment bank Chanson & Co. in Beijing. “So while there could be some volatility, the overall market should remain stable.”

READ: China Stocks May Rally 20% on a Full Reopening, Goldman Says (1)

Markets have been on a roller-coaster ride in recent days. A rout ignited by President Xi Jinping’s power grab and defense of Covid Zero at the Communist Party Congress was erased by last week’s surge, when speculation that China is moving toward reopening sent everything from equities to oil on a frenzied upswing.

On the mainland, the CSI 300 Index was up 0.5% mid-day after falling as much as 0.6% earlier. Trading volume on key gauges jumped, with that for the Hang Seng China index reaching double the three-month average.

“People should continue to monitor the details rather than the overall tones because the overall tones are not going to be different from what’s said in the 20th Congress,” Hao Hong, a partner at Grow Investment Group, said on Bloomberg TV on Monday.

Read: China Stock Frenzy Enters Overdrive on Hopes That Worst Is Over

--With assistance from Wenjin Lv, Chester Yung, John Cheng and Abhishek Vishnoi.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Ishika Mookerjee and Charlotte Yang