(Bloomberg) -- Cryptocurrencies extended declines as Binance’s potential takeover of embattled rival exchange FTX highlighted how strains in the digital-asset industry are now buffeting some of its top players.

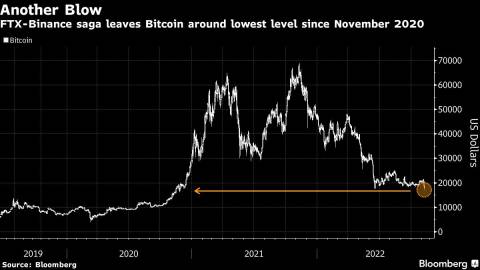

Bitcoin, the largest token by market value, fell as much as 3.8% on Wednesday after a near-10% decline a day earlier and was trading at about $18,120 as of 11:37 a.m. in Singapore. Just about every digital coin was struggling: Ether, Polkadot, Avalanche, Solana and meme token Dogecoin slumped.

Binance Chief Executive Officer Changpeng “CZ” Zhao stunned the crypto world on Tuesday with an announcement that his firm was moving to take over rival FTX.com, which he said was seeing a liquidity crunch.

Traders cited a Zhao tweet that a letter of intent between the two parties is nonbinding as contributing to the market turmoil. Investors are on edge about spreading contagion given the pivotal role FTX and its co-founder Sam Bankman-Fried played in the industry.

FTT, the utility token of the FTX exchange, has collapsed by more than 70% in the past 24 hours and was trading around $5, according to CoinGecko data.

The price of Sol, the native token of Solana blockchain -- which is associated with both FTX and linked crypto trading house Alameda Research -- posted dramatic drops alongside other tokens of Solana-based projects.

“The letter of intent is non-binding, which means that further issues could still arise if CZ/Binance decide to back out of the deal,” said David Moreno Darocas, research associate at CryptoCompare.

The letter of acquisition intent by Zhao’s Binance Holdings came after a bitter feud between with Bankman-Fried spilled into the open. Zhao actively undermined confidence in FTX’s finances, helping spark an exodus of users from the three-year-old FTX.com exchange.

A day before reaching a deal, Bankman-Fried said on Twitter that assets on FTX were “fine.”

Terms of the emergency buyout were scant, with Binance saying the agreement came after “a significant liquidity crunch” befell FTX and the firm asked for its help.

“SBF and FTX were the biggest patrons of Solana,” Teng Yan, a researcher at digital-asset research firm Delphi Digital, said on Twitter. “This era is over. Binance has taken over, and they will heavily favor BNB chain over Solana. Alameda had ~$1B in locked and unlocked $SOL, which they’ll have to sell if insolvent. This puts a huge sell pressure on $SOL.”

The FTX-Binance ordeal gave some traders flashbacks to the issues suffered by Celsius -- the crypto lender that collapsed earlier this year -- as well as those seen by other firms that were engulfed in this year’s crash in digital assets.

Teong Hng, CEO at crypto investment firm Satori Research, said the “situation is still very fluid” while adding “I am confident these two crypto giants will do the right thing to protect investors and the industry.”

--With assistance from Olga Kharif, David Pan, Yueqi Yang and Joanna Ossinger.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Vildana Hajric and Muyao Shen