(Bloomberg) -- Cryptocurrency prices steadied in a lull from the selloff sparked by the demise of Sam Bankman-Fried’s FTX empire, but investors are braced for more ructions as further digital-asset sector bankruptcies loom.

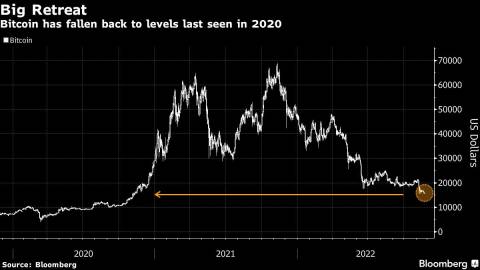

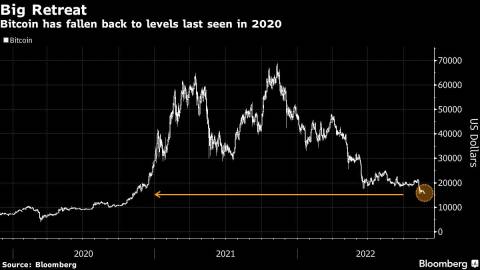

The largest token Bitcoin added about 1.5% on Tuesday while remaining below $16,000 and in sight of the weakest levels since November 2020. Coins such as Ether, Solana and meme token Dogecoin also posted modest gains.

The latest sign of contagion from the fall of the FTX exchange came from Genesis, a digital-asset brokerage that warned of possible bankruptcy unless it can raise cash. Crypto lender BlockFi Inc. is also struggling to stay afloat.

FTX’s unraveling “resembles Enron’s collapse much more than Lehman’s,” Peter Berezin, chief global strategist at BCA Research Inc., wrote in a note. He added that much of the crypto sector “is built on a rickety foundation of fraud and greed, which no amount of technobabble can disguise.”

Berezin reiterated a long-term target of $5,000 for Bitcoin, which was trading at about $15,860 as of 9 a.m. in Singapore.

Administrators picking over the wreckage of FTX’s bankruptcy have discovered that $3.1 billion is owed to top creditors. The scope of the money outstanding is stoking worries that more digital-asset outfits will topple.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Sunil Jagtiani