(Bloomberg) -- Binance Holdings Ltd., the world’s largest crypto exchange, sought to counter concerns about outflows by reiterating its position that user assets are underpinned by reserves while also flagging an absence of debt.

Responding to questions about the recent outflows and worries over transparency, a spokesperson said by email: “People deposit and withdraw assets everyday for a variety of different reasons. User assets at Binance are all backed 1:1 and Binance’s capital structure is debt free.”

Customers pulled funds from billionaire Changpeng “CZ” Zhao’s platform this week amid a lack of confidence in the crypto sector following the collapse of rival venue FTX. Sam Bankman-Fried, FTX’s co-founder, has been charged with fraud for allegedly misappropriating billions of dollars of customer money.

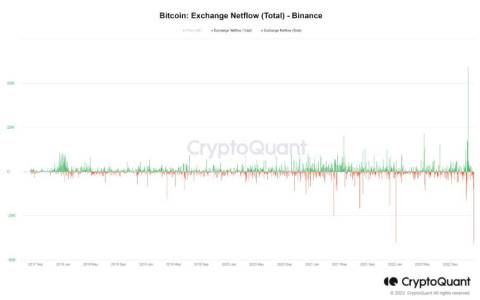

Binance saw a record daily net outflow of Bitcoin and Ether in terms of numbers of tokens on Tuesday, according to research firm CryptoQuant. A net 40,353 Bitcoins and 278,017 Ether tokens were withdrawn, the figures indicate.

In a tweet on Wednesday, Zhao said “things seem to have stabilized” and that “deposits are coming back in.” He’d earlier said that Binance saw about $1.14 billion of net withdrawals on Tuesday.

A net $256 million flowed into Binance in the past 24 hours as of 12:25 p.m. in Singapore on Wednesday, according to data from blockchain analytics firm Nansen. Over the past seven days, there was a net outflow of $1.2 billion. Nansen’s snapshot doesn’t take into account Bitcoin movements.

“We maintain hot wallet balances to ensure that we always have more than enough funds to fulfill withdrawal requests and we top up hot wallet balances accordingly,” the Binance spokesperson said in the email. Hot wallets are digital repositories for tokens that are connected to the internet.

Binance in a November blog post shared details of digital-asset wallet addresses with tokens worth about $69 billion.

Last week, the exchange released a proof of reserves report. The document, based on a snapshot review by accounting firm Mazars, showed the exchange having sufficient crypto assets to balance its total platform liabilities.

The report also acknowledged limitations as it didn’t amount to a full financial audit that would give a clearer picture of Binance’s overall health.

“We are working collaboratively with Mazars to share all relevant financial information with them so that they can verify the accuracy of all the data we have shared as well as our process for extracting the data,” the spokesperson said. “We are working on getting the next update for additional tokens published as soon as possible.”

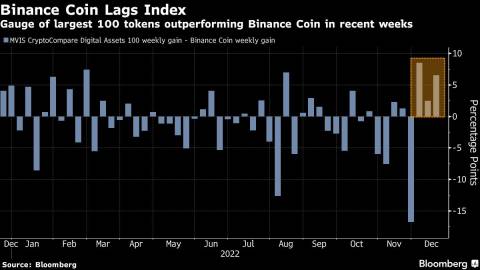

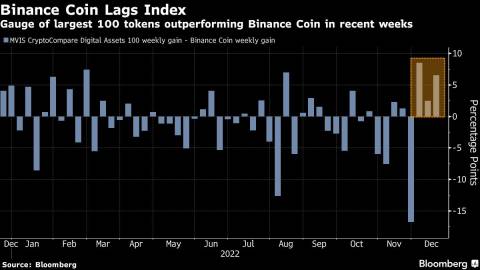

Binance Coin, the native token of Zhao’s ecosystem, could be viewed as an arbiter of investor sentiment toward the exchange. Over multi-year periods it’s significantly outperformed a gauge of the largest 100 tokens. But it’s down about 4% so far this week, even as the wider gauge has added roughly 2%, according to data compiled by Bloomberg.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

(Updates with latest tweet from Binance’s CEO Zhao in the fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Suvashree Ghosh and Sidhartha Shukla