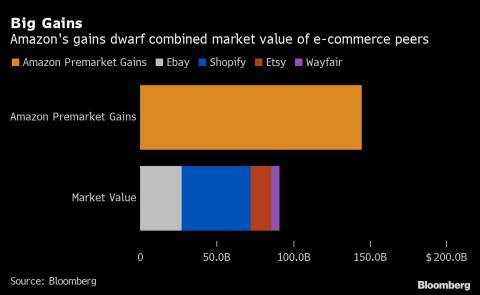

(Bloomberg) -- Amazon.com Inc. and Apple Inc. are set to add about $220 billion in market value Friday after they joined technology peers Alphabet Inc. and Microsoft Corp. in assuaging investor concerns by reporting higher revenue even as consumers curb their spending amid rising inflation.

Amazon jumped as much as 13% in US premarket trading, while Apple advanced 3%, before paring some of these gains.

Amazon expanded both its e-commerce and cloud-computing businesses, with Bloomberg Intelligence analysts noting that the company’s performance proves that “it is better positioned to weather inflationary pressures and benefits from a more-affluent customer contrary to Walmart.”

Meanwhile, Apple beat analysts’ revenue expectations thanks in part to higher iPhone sales at a time when global smartphone shipments are falling globally.

“Apple appears to be seeing no meaningful impact on its iPhone business in the current macro environment,” Piper Sandler analyst Harsh Kumar wrote in a research note. Also, restrictions on production in China eased at the end of the quarter, which “allowed some pent-up demand to be met,” he said.

Through Thursday’s close, shares of both companies have risen 15% in July. Amazon is poised for it largest monthly advance since April 2020, while Apple is on course for its biggest monthly gain since August of that year.

Alphabet and Microsoft rose 0.5% and 0.6%, respectively, in premarket trading.

(Updates stock moves throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Subrat Patnaik