(Bloomberg) -- Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what’s necessary to bring down demand in order to reach its 2% long-term inflation goal, a target that remains far off.

“We are committed to bringing inflation down and we’re going to do what we need to do,” he told CBS’s Face the Nation in an interview on Sunday. “We are a long way away from achieving an economy that is back at 2% inflation, and that’s where we need to get to.”

While inflation has continued to exceed policy makers’ expectations, and faster cost-of-living increases are becoming more broad-based, the Fed is “acting with such urgency to get it under control and bring it back down,” Kashkari said.

Faster inflation is being driven by supply chains disrupted by the war in Ukraine and other factors rather than by increasing wages, he said, adding that he sees no “self-fulfilling spiral” of wage-driven inflation yet.

Kashkari does not vote on monetary policy this year.

Fed officials raised interest rates by 75 basis points last week for the second straight month -- delivering the most aggressive back-to-back increase in more than a generation to tame inflation at a 40-year high.

Chair Jerome Powell told reporters after the July 27 decision that officials could do the same again at their next meeting in September -- depending on readings from the economy between now and then -- while pushing back on suggestions that the US is already in a recession.

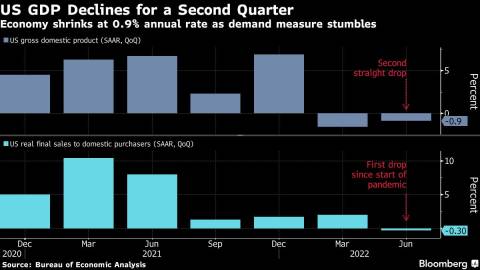

Data since then showed US gross domestic product contracting for the second consecutive quarter between April and June, meeting the threshold that some economists use as a rule-of-thumb to judge a recession.

The National Bureau of Economic Research’s business cycle dating committee -- the official arbiter of US recessions -- does not accept this view. Instead, the group of eight elite academic economists looks at half a dozen monthly economic reports to see a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Focus

Kashkari said that the Fed will do everything it can to avoid a recession, while acknowledging that it doesn’t have a “great record” of being able to do so.

“Whether we are technically in a recession or not doesn’t change my analysis,” Kashkari said. “I’m focused on the inflation data. I’m focused on wage data. And so far, inflation continues to surprise us to the upside. Wages continue to grow. So far, the labor market is very, very strong.”

Kashkari said he doesn’t expect the Democrats’ new tax, climate and drugs bill to have much impact on inflation in the next couple of years.

“Long term it may have some effect, but over the near term, we have an acute mismatch between demand and supply,” Kashkari said. “And it’s really up to the Federal Reserve to be able to bring that demand down.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Eric Martin