(Bloomberg) -- The push to leave London sparked by the coronavirus pandemic shows no sign of slowing down even after millions of workers returned to their city center offices.

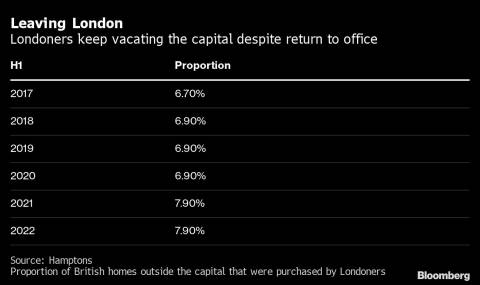

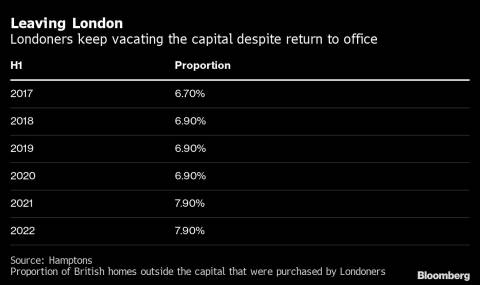

Almost 8% of the British homes purchased outside of the capital were bought by Londoners in the first half of the year, the same proportion as a year earlier when the post-Covid rush kicked off. That’s up from 6.9% in the first half of 2019, the year before the the pandemic struck, according to data compiled by broker Hamptons.

Buyers have flocked to the countryside in search of more green space after being cooped up in their homes during a series of lockdowns in 2020, taking advantage of more flexible working patterns and pent up savings. They’ve also headed for cheaper towns and cities away from the UK capital after the pandemic caused a spike in house prices that made London even less affordable.

“It’s becoming increasingly evident that one of the biggest covid-related housing market trends – moving out of London for the country - could be here to stay,” said Aneisha Beveridge, head of research at Hamptons. “Despite more people returning to London offices this year, the rate at which households have upped-sticks and headed out of town has continued apace.”

The rush out of London has accelerated house price growth in the UK regions, narrowing the persistent price gap with the capital. The higher values means people who traded their London home to buy outside the capital are now purchasing a property 26.4 miles from where they lived, 0.6 miles further than last year.

Movers accounted for 50% of the deals, while first-time buyers accounted for 28%. The remainder were bought by investors and those purchasing a second home. The most popular destinations for home movers included Epping Forest, Slough and Epsom & Ewell.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Jack Sidders