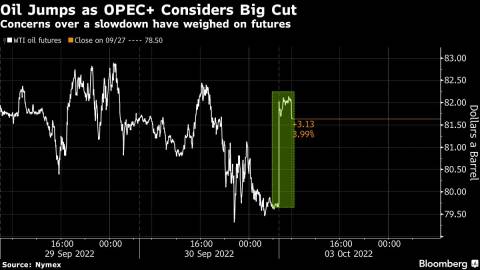

(Bloomberg) -- Oil surged to near $82 a barrel on indications the OPEC+ alliance is considering cutting production by more than 1 million barrels a day to revive plunging prices when it meets this week.

A reduction of that magnitude would be the biggest since the pandemic, although OPEC+ delegates said a final decision on the size of the cuts won’t be made until ministers gather in Vienna on Wednesday. West Texas Intermediate futures jumped around 3%, on track for the first gain in three sessions.

Oil plunged by a quarter in the three months through September as a slowing global economy sapped energy demand. Banks including UBS Group AG and JPMorgan Chase & Co. said recently that OPEC+ may need to lower output by least 500,000 barrels a day to stabilize prices.

A cut of more than 1 million barrels a day “will be enough to put a floor under prices,” said Phil Flynn, a senior market analyst at Price Futures Group.

A large output cut may draw criticism from the US and other major consuming-nations, where energy-driven inflation has forced central banks to aggressively jack up interest rates. This week’s meeting of the Organization of Petroleum Exporting Countries and its allies will be the first in-person gathering since March 2020.

In Asia, China issued new quotas for fuel exports and crude imports last week as it seeks to revive its economy, adding to bullish sentiment for oil. The world’s biggest crude importer has seen energy demand take a tumble due to virus lockdowns and a property slump this year.

“It’s only going to be a matter of time before oil returns to $100 a barrel, especially with supplies set to get tighten toward the end of the year,” said Suvro Sarkar, an energy analyst at DBS Bank Ltd. in Singapore.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Ben Sharples