(Bloomberg) -- China’s exports growth fell for the first time in more than two years in October, as demand weakens on rising risks of a global recession.

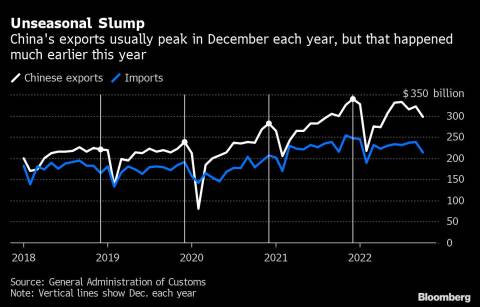

Exports in dollar terms fell 0.3% in October from a year earlier, the customs authority said Monday, well below the 4.5% gain projected by economists and down from September’s 5.7% increase. Imports also fell, with the 0.7% decline the first drop since August 2020. The trade balance climbed slightly to $85.1 billion last month from $85 billion in September.

The weakness in exports adds to the pressure on the economy, which is already struggling due to the property market slump, persistent disruptions from Covid controls, and weak consumer spending. Resilient exports had been a major support to China’s recovery in the past two years due to strong international buying, but that looks to have reversed as demand from the pandemic disappeared just as the war in Europe boosted global inflation and uncertainty.

“The weak export growth likely reflects both poor external demand as well as the supply disruptions due to Covid outbreaks,” according to Zhang Zhiwei, president and chief economist of Pinpoint Asset Management. “I expect export growth to remain weak in the next few months as the global economy slows.”

Read more: Global Trade Workhorses Ring the Recession Alarm: Supply Lines

Authorities had previously warned the momentum is expected to weaken further.

“The risk of external demand growth slowing is increasing” in the fourth quarter, commerce ministry spokeswoman Shu Jueting said at a regular briefing last month. The environment for trade was getting increasingly complex for China and uncertainties are still increasing, she said, citing slowdown in world economic and trade growth.

Aggressive policy tightening by major developed nations is raising fears of a global recession that would further hurt demand for China-made products. The US’s Federal Reserve last week increased benchmark interest rates for the sixth time this year. European nations are expected to follow suit.

Covid outbreaks and stringent control measures at home are another major source of concern. Mobility restrictions aside, the nation’s unswerving commitment to the Covid Zero strategy is dashing hopes of any quick improvement in the economic situation, promoting Chinese households to save at a record pace and cut back on spending.

China’s authorities offered little hint of plans to rescue the ailing economy at the Party Congress last month, which triggered a historic rout in the stock market. Investors should be able to have a clearer idea on whether China will ease up on its zero-tolerance approach to combating Covid and whether China will step up support for the real estate market in coming weeks, with a string of key economic meetings planned.

--With assistance from Fran Wang.

(Updates with details, new chart and economist’s comment.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Author: Bloomberg News